Hameral Order Flow Footprint

See buy/sell volume inside each candle, and spot POC, delta, imbalances and absorbtions fast. Includes a complex live data delta table.

![]()

✔️LifeTime License ✔️ Free Updates ✖️ No Order Flow+ Needed

Original price was: 299,00 €.199,00 €Current price is: 199,00 €.

🛡️Secured SLL Checkout

💳 All Major Cards

✖️ VAT Not Included

Description

Footprint PRO for NinjaTrader 8 lets you see real market control — with bid/ask volume, imbalances, and absorptions shown clearly on the chart.

It highlights key zones, colors buy/sell pressure, and sends Telegram alerts when major activity hits.

You get a delta heatmap, complex delta table, and delta profile to spot where big orders stack up.

Use volume filters to focus only on relevant levels — and group data for volatile assets so you don’t miss key setups.

It’s built for traders who want precision, not guesswork.

Features & Setups

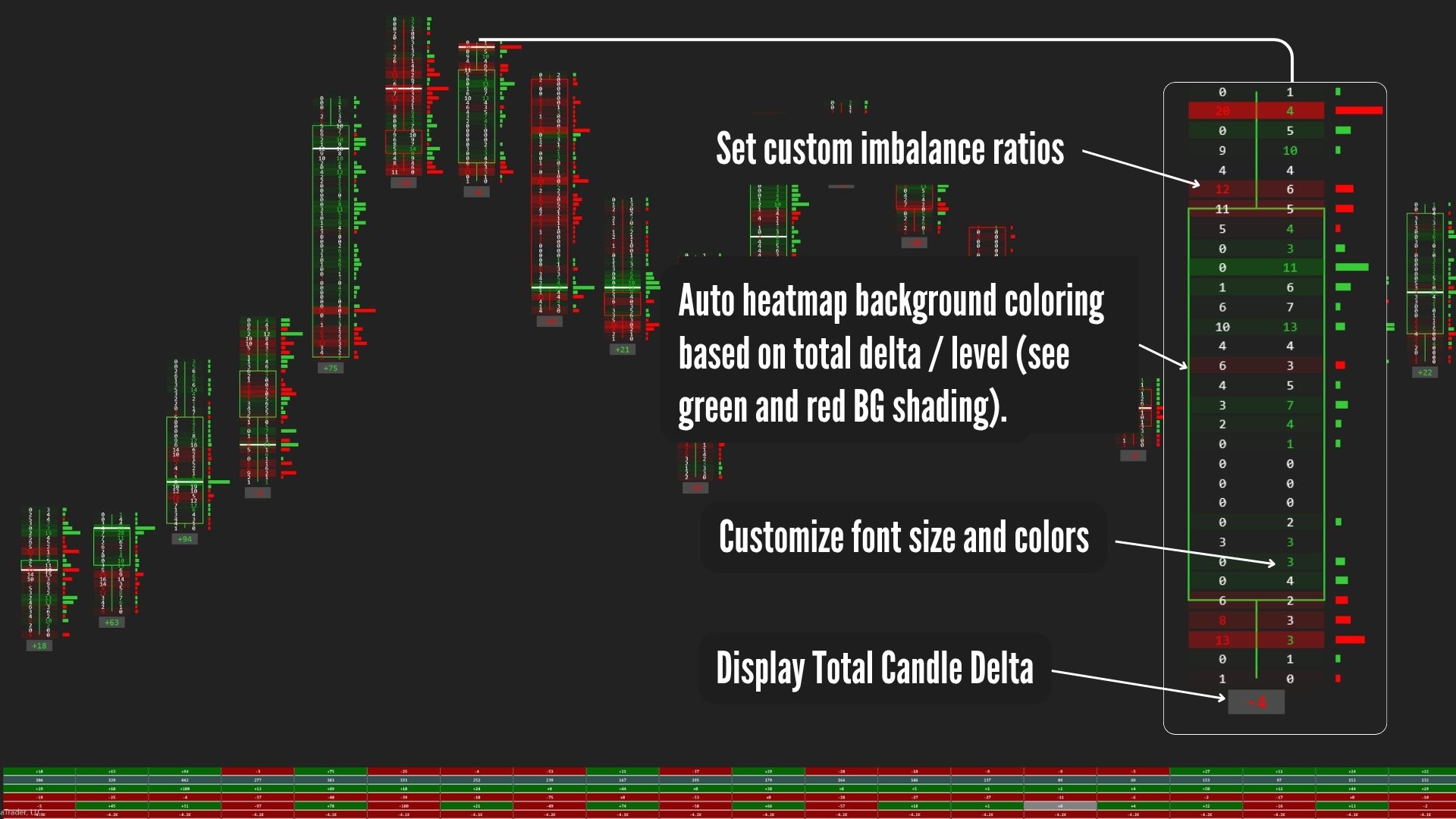

🔍 Precision Bid/Ask Display with Full Customization

Footprint PRO shows exact bid and ask volume per level, color-coded for fast reading. You control:

- Font size, color, and spacing

- Imbalance ratio thresholds and custom imbalance coloring

- Optional heatmap mode – the higher the delta at a level, the stronger the color intensity – making big volume zones pop instantly

- Show total candle delta below each bar, with your preferred color

This gives you visual clarity on who’s dominant at every level – buyers or sellers – so you act fast, not late.

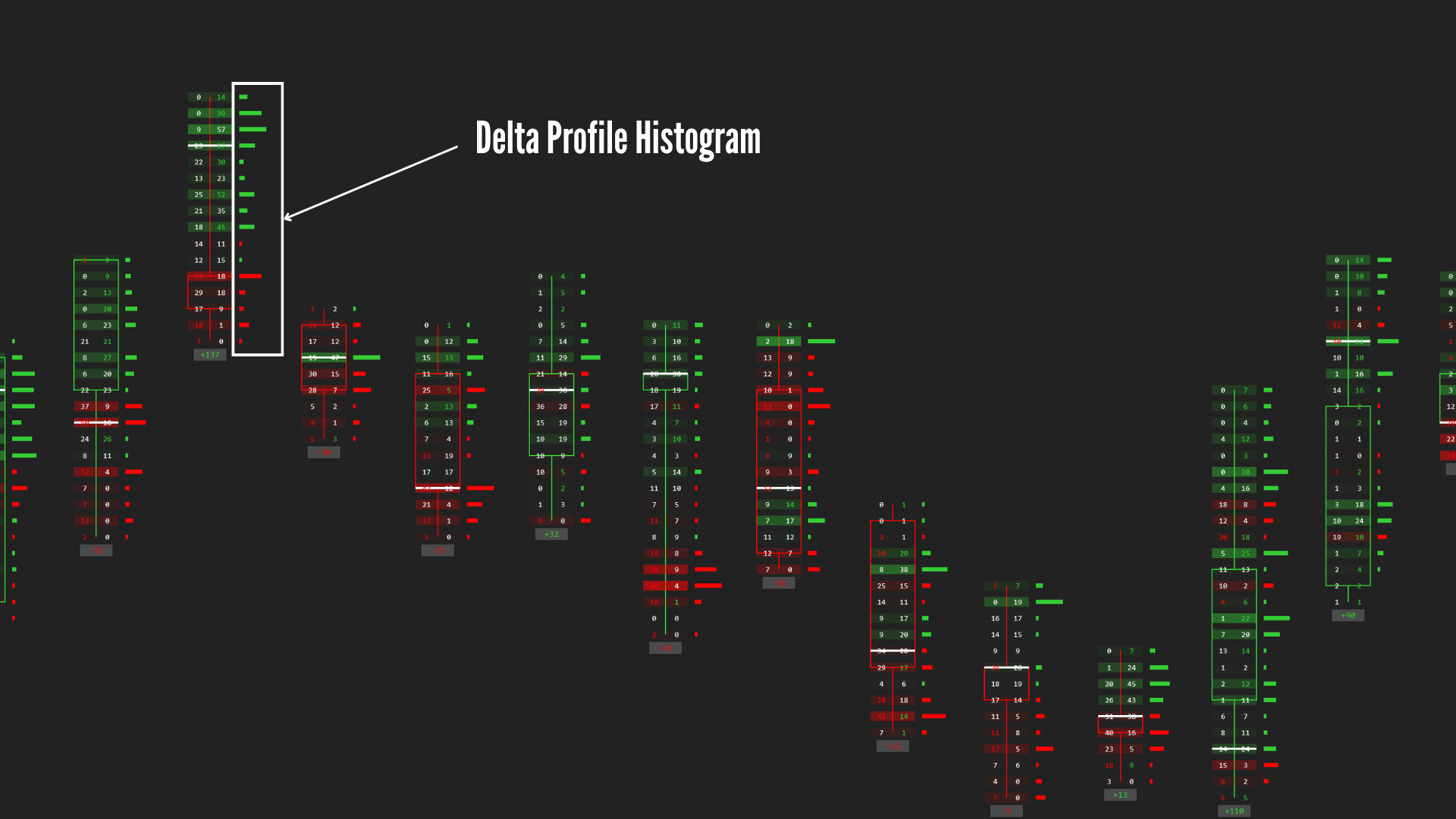

📊 Delta Profile Histogram for Fast Order Flow Reads

With Footprint PRO, you can display a delta histogram on the left side of each candle – making it easy to spot large imbalances between buyers and sellers at a glance.

You’ll instantly see where aggressive buying or selling is happening, helping you detect momentum shifts and key decision points.

The delta profile reveals where big orders are getting stuck or absorbed – especially at candle extremes – giving you early signs of reversals or continuation zones.

- Customize the width, spacing, thickness, and color of the delta visuals

This tool makes volume pressure visible – so you stop guessing and start reacting with confidence.

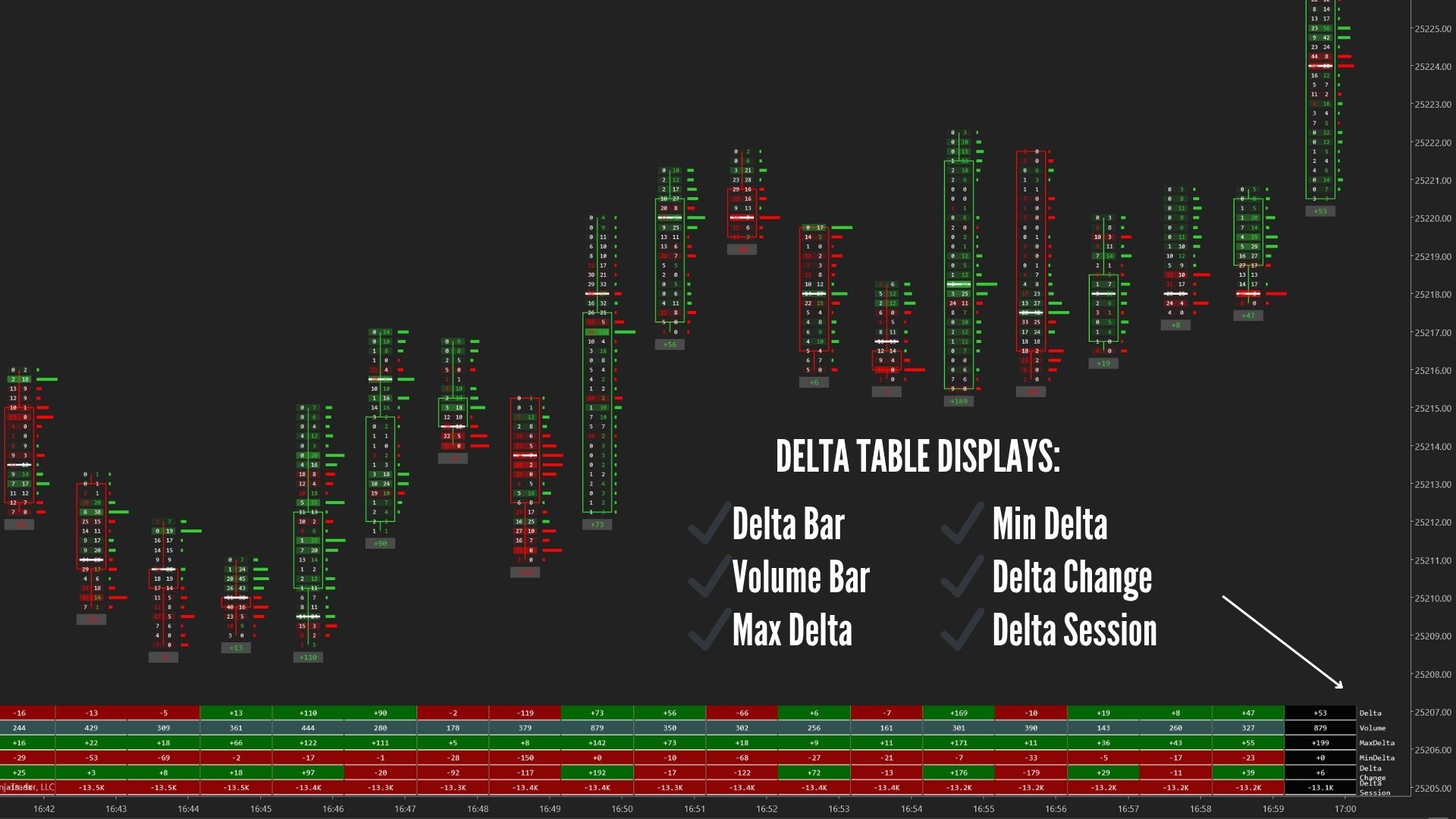

📋 Delta Info Panel

The Delta Info Panel gives you a compact, real-time view of the most important order flow metrics – right next to your candles.

You can display:

- Delta (per candle)

- Volume traded

- Max and Min Delta – to spot aggressive buyers or sellers

- Delta Change – to detect sudden shifts in control

- Session Delta – to understand who’s dominating the day

Fully customizable row height, font size, text color, and background colors for positive, negative, neutral, and volume data – so you read the panel effortlessly, even during fast markets.

It’s like having a live order flow cheat sheet on your chart – so you don’t miss critical context while trading.

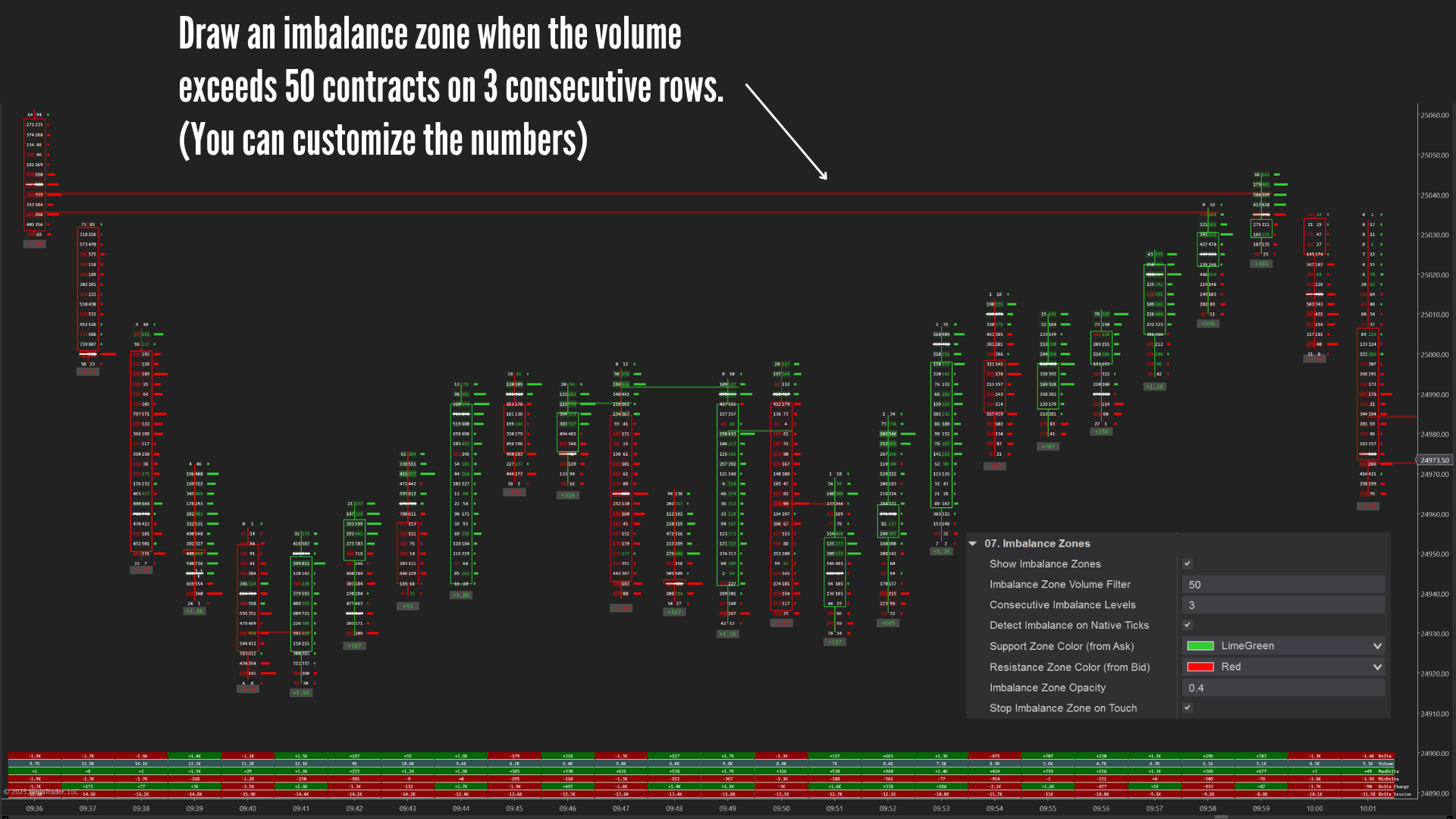

📌 Imbalance Zones – Spot Hidden Support & Resistance from Real Orders

The Imbalance Zones feature highlights areas where buying or selling pressure was clearly dominant — giving you real-time zones of support and resistance based on actual volume, not just price patterns.

When the bid or ask shows multiple stacked imbalances, the indicator marks that zone — showing you where large players stepped in aggressively.

- Volume Filter – only show zones formed by real size (e.g. 50+ contracts)

- Consecutive Levels – set how many imbalances are needed to form a zone (e.g. 3 stacked levels)

- Color-coded – green for support (Ask imbalance), red for resistance (Bid imbalance)

- Opacity setting – control visual intensity on your chart

- Auto-clear on touch – zones disappear after price trades through them

These zones are key because they often mark where price will stall, reverse, or launch from — helping you plan cleaner entries and exits with confidence.

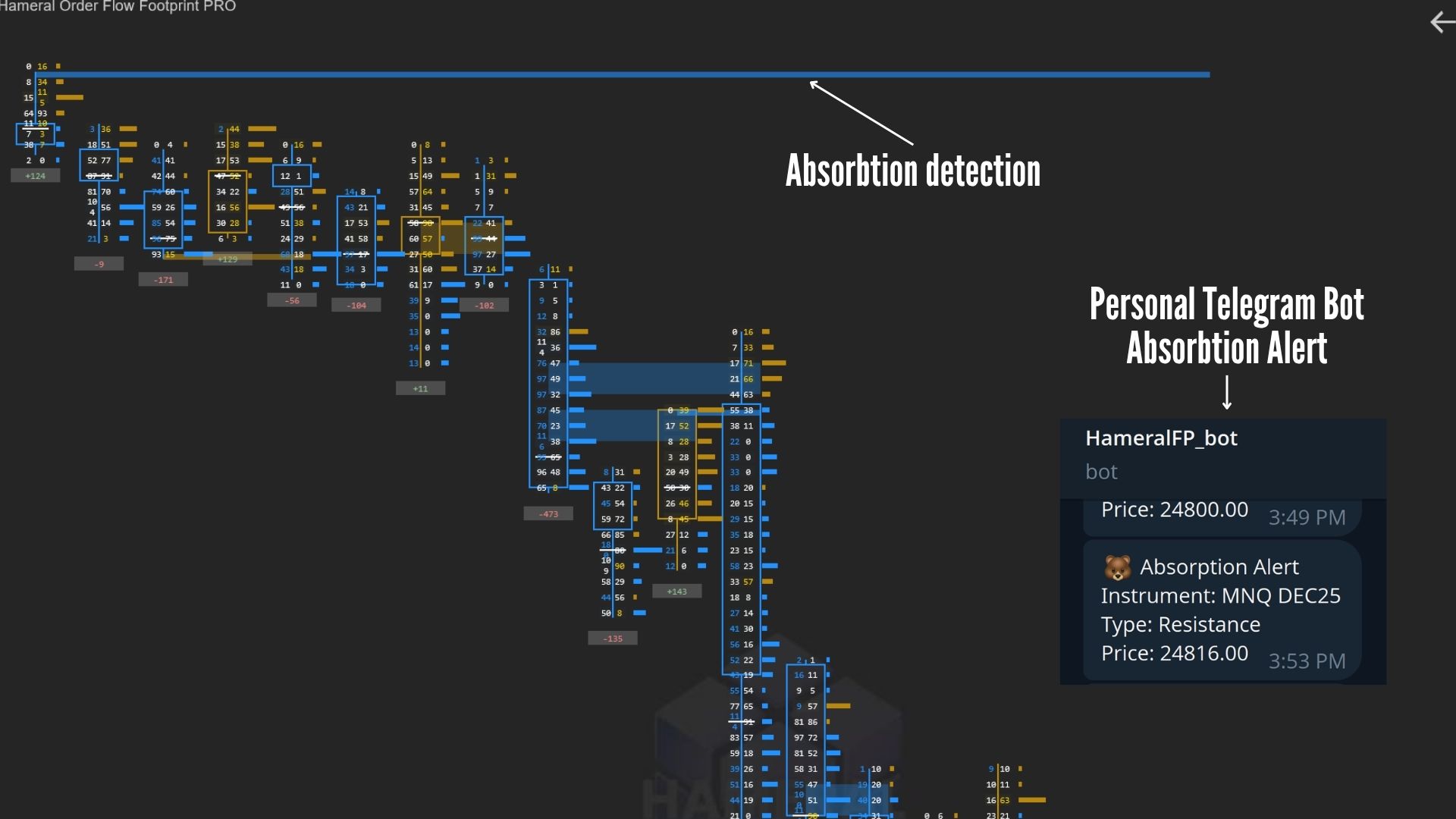

🛑 Absorption Zones – Catch Smart Money Holding the Line

Absorption Zones reveal where large hidden orders are stopping price in its tracks — even as aggressive buying or selling continues. This often signals potential reversals or strong breakouts.

Footprint PRO detects these areas automatically by analyzing order flow patterns where the tape is active but price refuses to move further.

- Consecutive Levels – set how many stacked absorption levels are required (e.g. 4 in a row)

- Absorption % – choose how much volume needs to be absorbed (e.g. 70%)

- Depth (in ticks) – define how deep the detection goes (e.g. 15 ticks)

- Volume Filter – ignore weak areas and focus only on meaningful absorption (e.g. 20+ contracts)

- Style it your way – color zones as support (green) or resistance (red), and control opacity for clean visibility

Best of all, you can connect your own Telegram bot and get real-time alerts the moment absorption is detected — so you’re never late to react.

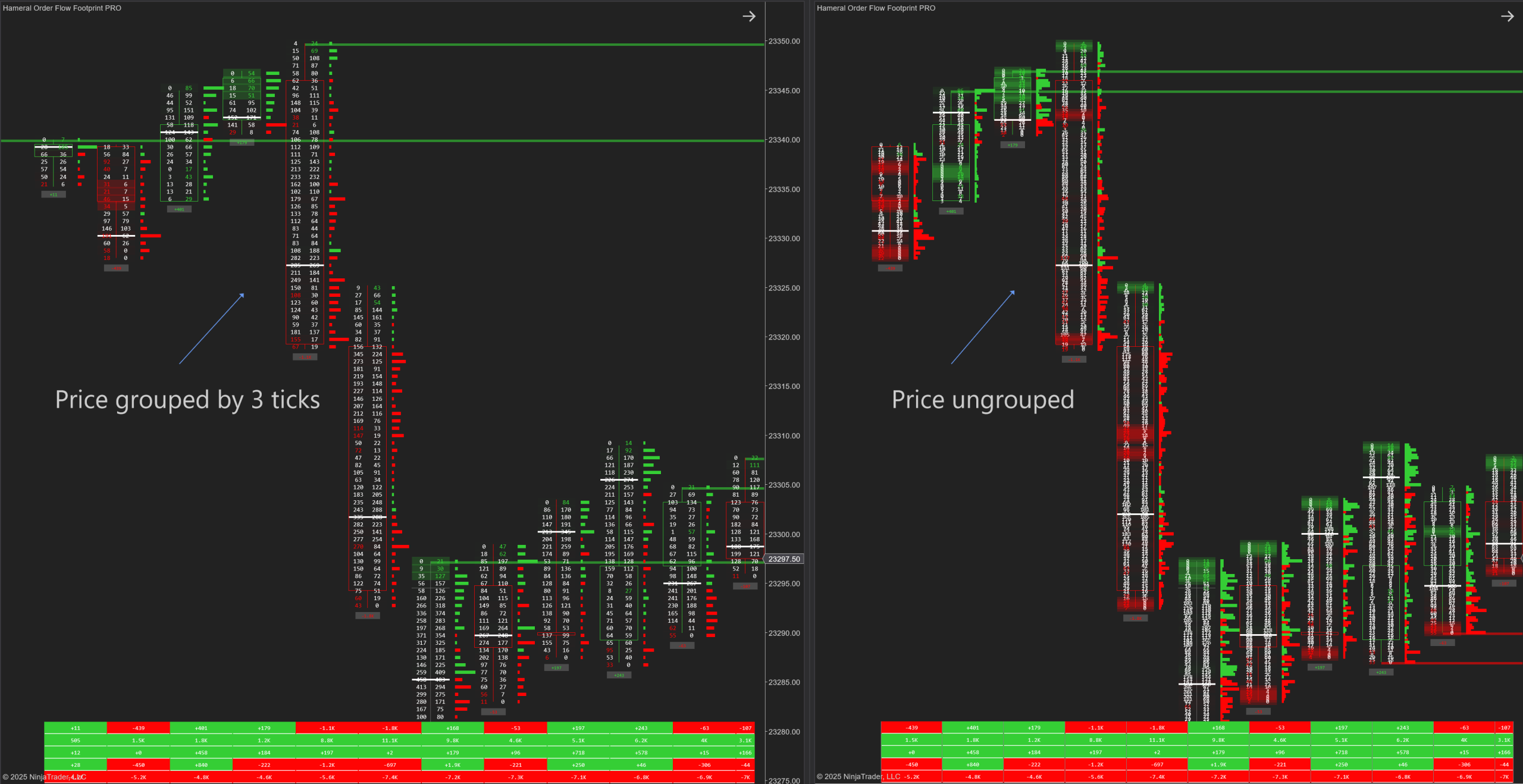

📐 Price Grouping – Clean Charts in High Volatility

When markets move fast, raw bid/ask data can get overwhelming. With Price Grouping, you can combine multiple price levels into one readable block using a custom tick multiplier (e.g. 10 ticks).

This helps you spot order flow patterns more clearly — especially on volatile instruments where precision and clarity matter most.

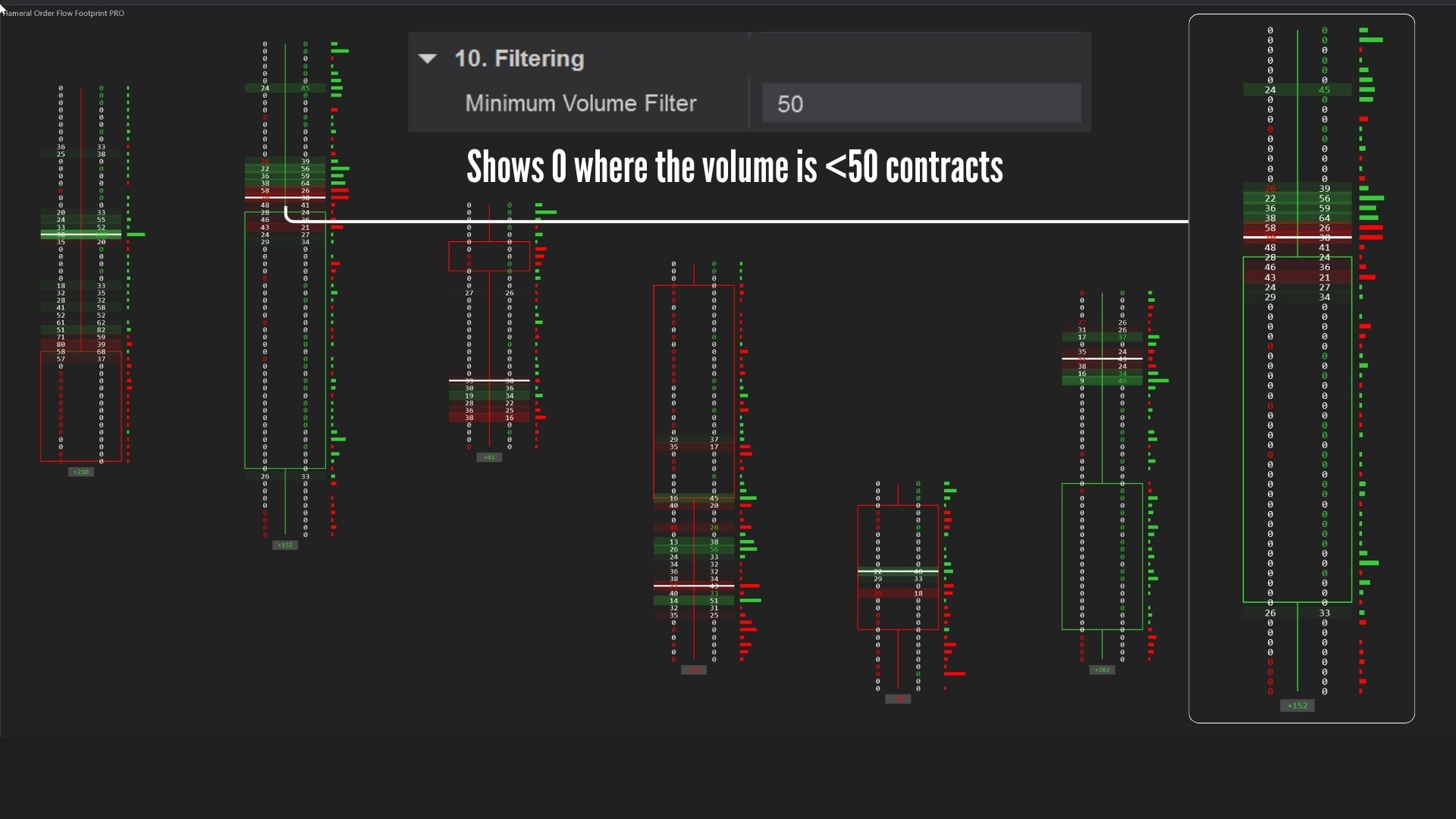

🔎 Volume Filtering – Focus Only on Real Activity

Don’t let low-volume noise distract you. With Volume Filtering, you choose the minimum contract size required for a level to appear on the footprint.

For example, if you set the filter to 50, the footprint will only display bid and ask values for levels where more than 50 contracts were traded. Everything else will show as zero — giving you a clean view of where real trading took place.

This ensures you focus only on meaningful buyer/seller activity — so your decisions are based on size that actually moves the market.

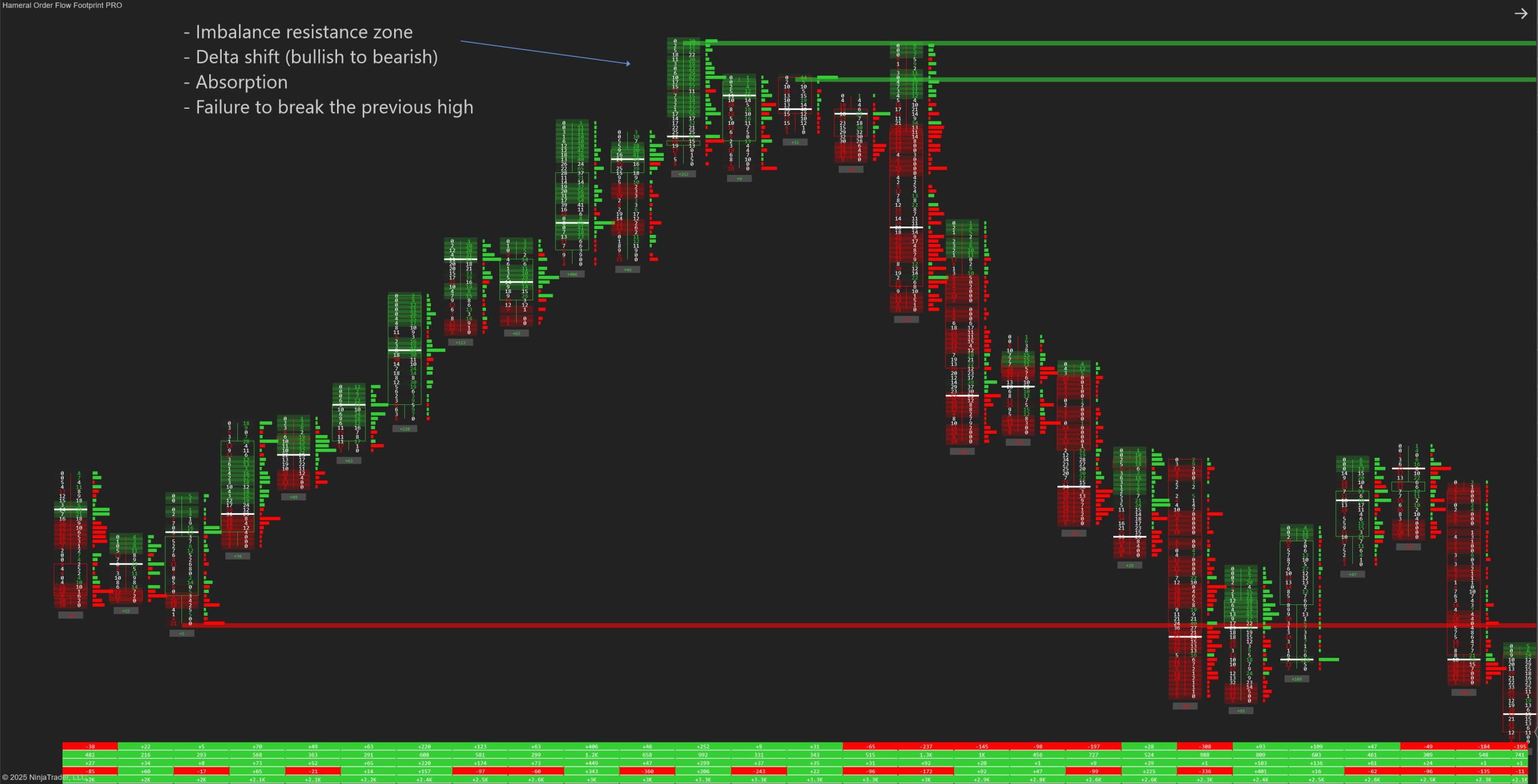

Examples

Price reached a key level and attempted a breakout. However, at the top, we observed heavy buy orders trying to push the price higher – but with no success.

The Footprint chart plots clear absorption at the highs. Price then closed below the POC, and both the Delta Bar and Delta Change are negative – signaling a potential reversal.